Chapter 7 - Deductions

7.1 For property that is liable for tax under the bright-line test, taxpayers will be able to deduct expenditure according to the ordinary rules.

The cost of the property can be deducted

7.2 A person who sells property that is subject to the bright-line test will be allowed a deduction for the cost of the property at the time of sale.

7.3 The cost of the property includes the amount that was paid to acquire the property (the initial acquisition price of the property). The cost of the property also includes any expenditure related to the acquisition. As a result, the costs of lawyers, valuers, surveyors and real estate agents are deductible. The incidental costs of disposing of the property are also deductible as part of the cost of the property. The cost of the property also includes any capital improvements to the property made after acquisition, such as renovations.

Holding costs deductible to the extent sufficient nexus and not private in nature

7.4 While a property is owned there will be periodic holding costs (of a non-capital nature) such as interest, insurance, rates and repairs and maintenance expenses.

7.5 The deductibility of holding costs that are currently deductible will not be affected by the bright-line test. Further, holding costs that are currently not deductible will not become deductible because of the bright-line test.

7.6 To be deductible as incurred, the holding costs must satisfy the normal deduction requirements. In other words, the holding costs are deductible to the extent they have a nexus with income and are not private in nature (or otherwise subject to any of the general limitations on deductions).

7.7 A deduction will be of a private nature if it is exclusively referable to living as an individual member of society. This will be determined by the specific facts of any given situation. However, interest costs can automatically be deducted if the property is owned by a company (subject to some limitations).

7.8 For example, when the property is part of a business or profit-making undertaking or scheme, and there is no private use, it is likely that the nexus will be satisfied. Further, when the property is rented out there will likely be a nexus between the holding costs and the rental income. However, if a person purchases a bach for family use, but sells the bach within two years, the holding costs will not be deductible because of the private limitation.

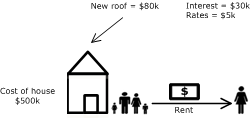

Example: Rental property

May 2016: Carla buys a rental property for $500k

May 2016 to 31 March 2017: Carla pays interest of $30k and rates of $5k

July 2016: Carla gets a new roof put on the building at a cost of $80k

2 April 2017: Carla sells the property for $800k

Deductions in 2016–17 year = $35k (interest and rates)

Deductions in 2017–18 year = $580k (Cost base of property = house and roof)

Income in 2017–18 year = $800k

Example: Beach house

May 2016: Denise buys a beach house for $500k solely for private use

May 2016 to 31 March 2017: Denise pays interest of $30k and rates of $5k

July 2016: Denise gets a new roof put on the building at a cost of $80k

2 April 2017: Denise sells the beach house for $800k

Deductions in 2016–17 year = $0 – The interest and rates are subject to the private limitation

Deductions in 2017–18 year = $580k (Cost base of property = house and roof)

Income in 2017–18 year = $800k