Chapter 6 - Exceptions for inherited property and relationship property

6.1 In addition to the main home exception, we suggest two further situations when the disposal of residential land is not intended to give rise to a tax liability under the bright-line test. The two situations are when the property is transferred:

- on the death of a person; or

- under a relationship property agreement.

Property transferred on the death of a person

6.2 When a person dies, their property may be sold or transferred to a beneficiary, who may subsequently sell the property. It is intended those disposals will not trigger a liability for tax under the bright-line test.

Transfer of property from deceased to beneficiaries

6.3 When a taxpayer dies, an estate can be dealt with in several ways, depending on whether a will exists. A will usually provides for the appointment of one or more executors. In the absence of a will, a court will appoint someone to administer the deceased’s estate (an administrator).

6.4 The executor or administrator is vested with legal and beneficial ownership of the deceased’s property from the time of death to the end of the period of executorship or administration. The beneficiaries have a right to have the deceased’s estate administered properly during this period but do not have a legal or beneficial interest in the assets.

6.5 The duties of the executor or administrator are to collect the assets of the deceased, pay all debts, testamentary expenses and taxes and to distribute the legacies. At the end of the period of executorship or administration, the executor or administrator becomes a trustee of the residual assets on behalf of the beneficiaries.

6.6 Normally, it takes nine to twelve months to wind up an estate with real property and distribute the assets to the beneficiaries. Property that has been bequeathed or devised under a will may be gifted as a specific legacy, general legacy or residuary gift. Specific legacies are treated as taking effect from the date of death, so income arising from the property is derived by the beneficiary from the date of death. A general or residuary legacy vests in a beneficiary at the time of distribution.

Transfers of land subject to the current land rules

6.7 Tax law treats the distribution of property following the death of a person as two transfers. The first transfer is from the deceased person to the administrator or executor and is deemed to occur immediately before the person dies. The second transfer is from the executor or administrator to the beneficiary and occurs on the date of the relevant transaction. The current rules distinguish between:

- transfers to a surviving spouse, de facto partner or civil union partner (relationship partners), a close relative or a charity; and

- other transfers.

6.8 These two situations are discussed below.

Certain transfers to a relationship partner, close relative or charity

6.9 The current rules provide special treatment (commonly referred to as “rollover relief”) for transfers to relationship partners, close relatives and charities (subject to certain conditions).

6.10 The effect of the rollover relief is not to tax the deceased person or their estate for any possible tax liability on the disposal of the property but to delay any tax liability until any subsequent disposal by the beneficiary.

6.11 The rollover relief is achieved by deeming the transfers from the deceased person to the executor or administrator, and from the executor or administrator to the beneficiary, as a disposal and acquisition of the property at the total cost of the land to the deceased person at the date of transfer (rather than at the land’s market value). The effect of this is that no tax liabilities under the current land rules arise under the transfers. When a major development is being undertaken on the land, it is treated as being disposed of for, and acquired at, the market value of the land at the commencement of the undertaking or scheme plus any expenditure that has been incurred on the development. This has the effect of transferring the land at its tax book value so no income tax liability is triggered on the transfer. Further, if a person holds land which would be taxable if sold within 10 years of acquisition, the person’s death will not trigger a tax liability.

6.12 Instead, the relevant time periods under the current land rules and the intentions of the deceased person are inherited by the beneficiary. This means that if the beneficiary subsequently disposes of the property, they will be subject to any of the applicable current land rules and so may be subject to income tax on any gains they derive from the sale.

6.13 Not all transfers to relationship partners, close relatives or charities are accorded rollover relief. The current rules provide certain conditions that must be satisfied for the rollover relief to apply.

Other transfers

6.14 Rollover relief is not accorded if the transfer is:

- to a person other than a relationship partner, close relative or charity; or

- to a relationship partner, close relative or charity but the relevant conditions for rollover relief are not satisfied.

6.15 In those situations, the property is deemed to be:

- transferred from the deceased person to the executor or administrator at market value, which may trigger a tax liability if the market value is greater than the cost of the property;

- transferred from the executor or administrator to the beneficiary at market value, which may trigger a tax liability; and

- acquired by the beneficiary on the date of the transfer to the beneficiary. The beneficiary may in their own right be subject to one of the current land rules on the disposal of property. For example, a relevant zoning change may occur after they acquire the property or they may be subject to one of the 10-year rules. If that is the case, the disposal by the beneficiary may also be subject to tax.

Options

6.16 Various options have been considered about how the proposed bright-line test would apply to land that was transferred following a person’s death. Specifically, consideration has been given to:

- applying the current rollover relief provisions to land subject to the proposed bright-line test;

- applying the current rollover relief provisions but also allowing an exemption for any subsequent disposal of the land by the beneficiary; or

- extending the current rollover relief to all transfers following the death of a person and providing an exemption for any subsequent disposal by the beneficiary.

6.17 We recommend the third option. All the options are discussed below.

Applying the current rollover relief

6.18 Applying the current rollover relief provisions to land subject to the bright-line test would extend the concessionary treatment only to land transferred to relationship partners, close relatives and charities (in certain circumstances). In such circumstances, the transfers to the executor or administrator, and from the executor or administrator to the beneficiary, would not generate a tax liability. However, any subsequent disposal by a relationship partner or close relative could be subject to the bright-line test if the property was sold within two years from the registration date of the acquisition by the deceased person.

6.19 A transfer to someone other than a relationship partner, close relative or charity (or a transfer that does not satisfy the relevant conditions) would not be accorded rollover relief. Instead, the death of a person within two years from the registration date of acquisition of residential property would trigger the bright-line test (subject to the exception for the main home). Likewise, the subsequent transfer from the executor or administrator to the beneficiary might also trigger the bright-line test if it occurred within two years. Further, any subsequent disposal of the property by the beneficiary within two years from the date of transfer might trigger the bright-line test.

Applying the current rollover relief and an exemption

6.20 Consideration has also been given to applying the current rollover relief provisions but also providing an exemption for any subsequent disposal by the beneficiary. The basis for this approach would be that the beneficiary had not intended to acquire the property, and so should not be deemed to hold the property on revenue account just because the deceased person had held the property on that basis. This would be in contrast to the current land rules, which do deem a beneficiary to hold the property on revenue account if the deceased person held it on revenue account. Applying an exemption for the bright-line test would, therefore, be more concessionary than the current land rules. However such an approach would only apply to relationship partners and close relatives.

Extending the current rollover relief to all transfers following a death and an exemption

6.21 The preferred approach for the bright-line test is to extend the current rollover relief to all transfers following a death and to provide an exemption under the bright-line test for any disposals by the executor or administrator and subsequent disposals by the beneficiaries.

6.22 The basis for extending the rollover relief is that because the bright-line test applies more broadly than the current land rules, it is appropriate to provide a broader exception for transfers following the death of a person. In that sense, it is considered appropriate the rollover relief applies no matter what the relationship is between the deceased person and the beneficiary. In other words, the relationship of the beneficiary to the deceased person should not determine the tax treatment of the transfer under the bright-line test following a death.

6.23 The basis for allowing an exemption from the bright-line test for a sale by the executor or administrator, or any subsequent sale by the beneficiary, is the same as described above. Specifically, the basis for the approach is that the beneficiary has not intended to acquire the property, and so should not be subject to the bright-line rule, which is intended as a buttress to the intention of resale rule.

6.24 The proposed exception for the bright-line test would not prevent the current land sale rules applying to any subsequent sale of the property by the beneficiary (if it would have been taxable had the deceased person sold it). The exception will have the effect of not bringing into the tax base any sales of inherited property that would not have been brought into the tax base under the current rules.

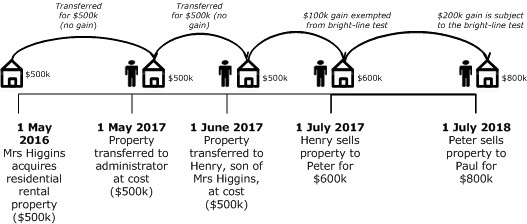

Summary

6.25 The bright-line test is intended to apply to most disposals of residential land within two years of the acquisition of the property. However, there is an exception for land transferred as a result of a death. The current rules provide rollover relief for transfers following a death to relationship partners, close relatives or charities but not other transfers. The preferred approach for the bright-line test is to extend the current rollover relief to all transfers following a death and to provide an exemption for any disposals by the executor, administrator or beneficiaries.

Example: Inheritance

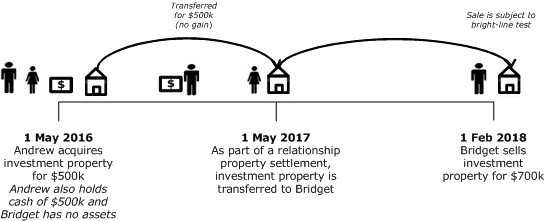

Property transferred under a relationship property agreement

6.26 When a relationship breaks down, property may be transferred between the spouses or partners. The property may then subsequently be sold. It is intended that the transfers of property under a relationship property agreement will not be subject to a tax liability under the bright-line test. However, any subsequent sale of the transferred property may be subject to the bright-line test.

Transfer of property under a relationship property agreement

6.27 During a marriage, civil union or de facto relationship, the parties hold any property according to the conventional laws relating to property. As a result, the parties are free to deal with their property during the relationship without regard to the provisions of the Property (Relationships) Act 1976.

6.28 When a relationship breaks down, the Property (Relationships) Act 1976 may be invoked by a court order or an agreement between the parties. When the statutory regime is invoked, new property rights operate from the date of the court order or agreement. The property of the spouses or partners is reapportioned between them under principles derived from the statutory regime. Each item of property is divided into one of two statutory categories:

- relationship property; and

- separate property.

6.29 The fact that a particular item of property is placed within one of these two categories then produces a prima facie result in the way it is treated as between the two spouses or partners. Prima facie all relationship property is divided in equal shares, while separate property is retained by the owner.

6.30 Spouses or partners can enter into an agreement under the Property (Relationships) Act 1976 in an on-going relationship (often referred to as a section 21 agreement). Such agreements cannot transfer ownership of property but may only affect the “status” of property (that is, whether it is “separate property” or “relationship property”).

Transfers of land subject to the current land rules

6.31 Land that is subject to the current land rules that is transferred under a relationship property agreement is eligible for rollover relief that is similar to that described above. In other words, for such land the transfer is treated as a disposal and acquisition for an amount that equals the total cost of the land to the transferor. When a major development is being undertaken on the land then it is treated as being disposed of for, and acquired at, the market value of the land at the commencement of the undertaking or scheme plus any expenditure that has been incurred on the development. The effect of this is that no tax liabilities under the current land rules arise under the transfers.

6.32 A subsequent disposal of the land by the transferee will be taxable under the current land rules if:

- the property is sold for more than the cost of the land to the transferee; and

- the amount would have been income of the transferor under the current land rules if they had disposed of the land.

Preferred option

6.33 The preferred option is to retain the current rollover relief for transfers under a relationship property agreement for the bright-line test. This will mean that no tax liability under the bright-line test arises for the transfer of the property under the relationship property agreement. However, the transferee may be liable under the bright-line test for any subsequent disposal of the property. A liability will arise if the property is disposed of within two years of the registration date on the acquisition by the transferor (and the property was not the transferee’s main home).

Why adopt a different approach to transfers on the death of a person to a transfer under a relationship property agreement?

6.34 As discussed above, the preferred approach for the bright-line test following the death of a person is to extend the current rollover relief to all transfers, and to provide an exemption for any subsequent disposals by the beneficiaries. In contrast, the preferred approach for the bright-line test for a transfer under a relationship property agreement, is to retain the current rollover relief and not provide an exemption for any subsequent disposal by the transferee.

6.35 Accordingly, the preferred approaches under the bright-line test differ for property transferred following a death to that under a relationship property agreement. It is acknowledged it could be argued that the same approach should be adopted to both types of transfers. It is considered, however, that there is a principled basis for distinguishing between the two circumstances, and providing for different treatments. Specifically:

- In most cases, for the property to be transferred as relationship property under a relationship property agreement the relationship will have had to be in existence for at least two years’. This means that for the most part, property that is subject to the bright-line test would have been acquired during the relevant relationship. It can, therefore, be presumed that both parties to the relationship had a joint purpose or intention in relation to the property when it was acquired. In those circumstances, it is more appropriate to apply the bright-line test to either party following the end of the relationship.

- A transferee following a death does not have any choice about what property is transferred to them. They can refuse the legacy or gift but they cannot choose to receive different property. The transferee, therefore, may become a reluctant landlord or property investor following a legacy or gift and it seems appropriate to allow them to dispose of the property in those circumstances without being liable to tax. In contrast, there is more opportunity to negotiate the property that a transferee receives under a relationship property agreement. In those circumstances, it seems more appropriate to apply the current rollover relief but have no exemption for any subsequent sale.

Example: Relationship property settlement