Cross-border supplies of remote services to New Zealand-resident consumers

- Summary of proposed amendment

- Key features

- Background

- Detailed analysis

- Changes to the place of supply rules

- Summary of the new place of supply rules for non-resident suppliers of services

- Definition of “remote service”

- Telecommunications services

- GST registration threshold

- Determining whether a customer is resident in New Zealand

- Non-double taxation rule

- Effect on suppliers’ residency and income tax obligations

(Clauses 47(1), 47(4), 47(8), 49(1), 49(2), 50, 53(1), 55(3), 62 and 63)

Summary of proposed amendment

The bill proposes amendments to the GST Act that will apply GST to cross-border “remote services” provided to New Zealand-resident consumers, by requiring offshore suppliers to register and return GST on these supplies.

Key features

Changes to the place of supply rules

A definition of “remote services” is inserted in section 2, which defines a “remote service” as a service where, at the time of the performance of the service, there is no necessary connection between the physical location of the customer and the place where the services are performed.

An amendment to the definition of “goods” under section 2 is proposed to further exclude a product that is transmitted by wire, cable, radio or other electromagnetic system, regardless of whether it is transmitted by a non-resident supplier to a resident recipient.

Proposed section 8(3)(c) is inserted into the place of supply rules, which deem supplies of “remote services” (as defined) supplied by a non-resident to a person resident in New Zealand to be a supply made in New Zealand, and therefore subject to GST.

Supplies of remote services that are physically performed outside New Zealand to residents in New Zealand who are not registered persons will be excluded from zero-rating through amendments proposed to section 11A(1)(j).

Registration threshold

As a consequence of proposed section 8(3)(c), non-resident suppliers will be required to register and return GST when their supplies of remote services to New Zealand exceed NZ$60,000 in a 12-month period. Supplies to New Zealand GST-registered businesses will only count towards this threshold if the parties agree that the supply is zero-rated (discussed in the next section of this commentary).

Determining whether a customer is resident in New Zealand

Proposed section 8B establishes rules that non-resident suppliers of remote services must follow to determine when a remote service is supplied to a person resident in New Zealand. Proposed section 8B(2) will require the non-resident supplier to treat a customer as a New Zealand resident on the basis of two non-conflicting pieces of evidence that support the conclusion the person is resident in New Zealand.

Proposed section 8B(2) provides a list of proxies that can be used for these purposes:

- the person’s billing address;

- the internet protocol (IP) address of the device used by the person or another geolocation method;

- the person’s bank details, including the account the person uses for payment or the billing address held by the bank;

- the mobile country code (MCC) of the international mobile subscriber identity (IMSI) stored on the subscriber identity module (SIM) card used by the person;

- the location of the person’s fixed landline through which the service is supplied to them; and

- other commercially relevant information.

Proposed section 8B(3)(a) provides that, if a supplier has more than one set of evidence that meets the test of two non-conflicting pieces, where one set supports the conclusion that the customer is resident in New Zealand and another supports the conclusion that the customer is resident in another country, the supplier is required to choose the more reliable set of evidence.

Proposed section 8B(3)(b) allows the Commissioner of Inland Revenue to prescribe another method to determine a recipient’s residence if a supplier is unable to establish a recipient’s residence by two non-conflicting pieces of evidence as described above.

Non-double taxation rule

Proposed section 20(3)(dc) prevents double taxation from arising on supplies of remote services that are physically performed in New Zealand and received by a non-resident consumer in New Zealand, by allowing a deduction against their liability for GST in New Zealand, when the supply has been taxed in another jurisdiction, to the extent that the supply is taxed in the other jurisdiction.

Background

When GST was introduced in 1986, few New Zealand consumers purchased offshore services and online digital products were not available. The rules that determine whether GST applies to a supply of services (the “place of supply rules”), therefore envisaged GST applying on the basis of whether a service of a more tangible nature is physically performed in New Zealand. Under these rules, supplies of services that are physically performed outside of New Zealand are not subject to GST, even if they are supplied to New Zealand-resident consumers.

International developments

Non-taxation of cross-border remote services and intangibles is an international issue faced by countries that have a GST or VAT system. The OECD has developed international VAT/GST guidelines, which establish an international set of principles for determining when countries have the right to tax these supplies. This is expected to minimise the potential for double taxation or double non-taxation in the trade of cross-border services and intangibles.

The OECD guidelines recommend two general rules for determining the place of taxation for supplies of services and intangibles to consumers:

- for “on-the-spot” services, where it is necessary for the supplier and customer to be in the same location when the services are supplied, the jurisdiction where the service is performed should have taxing rights; and

- for “remote” services, where it is not necessary for the supplier and customer to be in the same location when the services are supplied, the jurisdiction in which the customer has their usual residence should have taxing rights.

The distinction between “remote” and “on-the-spot” services is intended to allocate taxing rights to the jurisdiction where it can reasonably be assumed that the consumer consumes these supplies.

The OECD guidelines suggest that in order to collect GST on these supplies, offshore suppliers could be required to register and return GST in the jurisdiction of the consumer’s usual residence.

The OECD guidelines can be found at the link below:

http://www.oecd.org/ctp/consumption/international-vat-gst-guidelines.htm

The offshore supplier registration model has been adopted for cross-border services and intangibles in a number of jurisdictions, including the European Union, Norway, South Korea, Japan, Switzerland and South Africa. Australia has also announced plans to introduce the model. Countries that have implemented such a system report success in collecting GST/VAT on these supplies.

Current place of supply rules

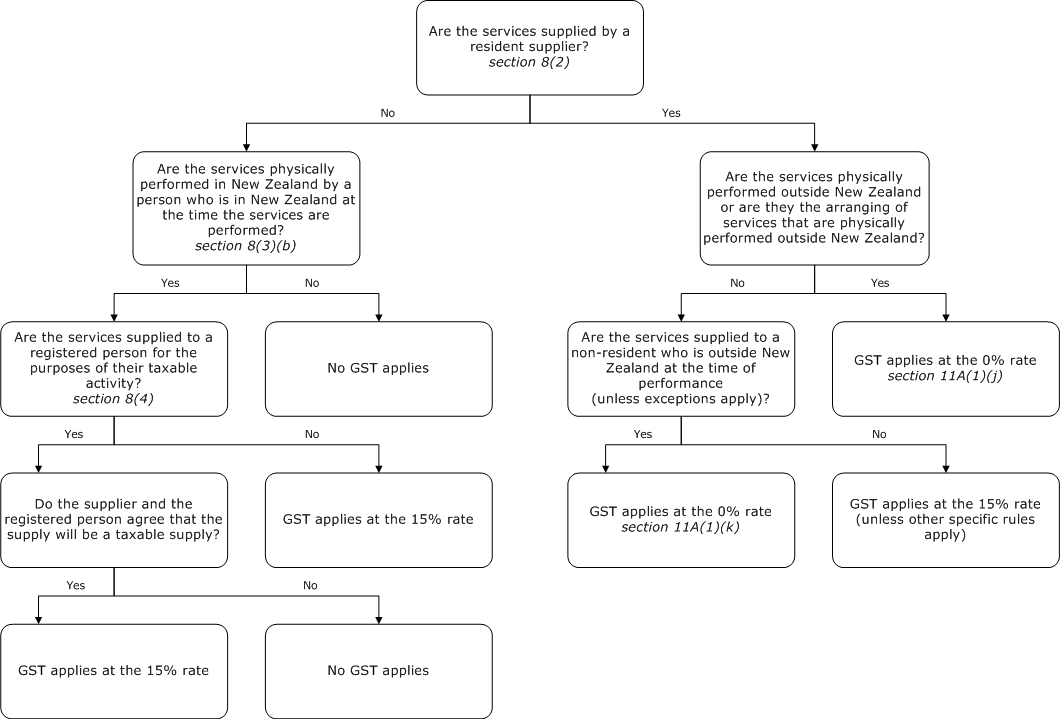

The GST Act adopts an iterative approach to determining whether a good or service is considered to be supplied in New Zealand, and therefore whether GST applies to the supply. The place of supply rules in section 8 of the Act are then followed by a range of exclusions that determine whether the supply is zero-rated or exempt.

The current place of supply rules generally apply GST on the basis of where services are physically performed. Services that are physically performed outside New Zealand will generally not be subject to GST if supplied by a non-resident, and will generally be zero-rated if supplied by a resident.

Under section 8(2) of the Act, when a New Zealand-resident person supplies services, the supply is deemed to be made in New Zealand and therefore subject to GST. However, if the services are physically performed outside New Zealand, the supply will be zero-rated under section 11A(1)(j).

If a non-resident person supplies services, the starting point is that the supply will be deemed to be made outside New Zealand, and therefore not subject to GST. However, under section 8(3)(b), services are deemed to be supplied in New Zealand if the services are physically performed in New Zealand by a person who is in New Zealand at the time of performance. However, section 8(4) provides that if a supply is made to a GST-registered business for the purposes of carrying on their taxable activity, the services are deemed to be supplied outside New Zealand, and therefore are not subject to GST, unless the parties agree that GST will apply.

Summary of the current place of supply rules for services

Detailed analysis

Changes to the place of supply rules

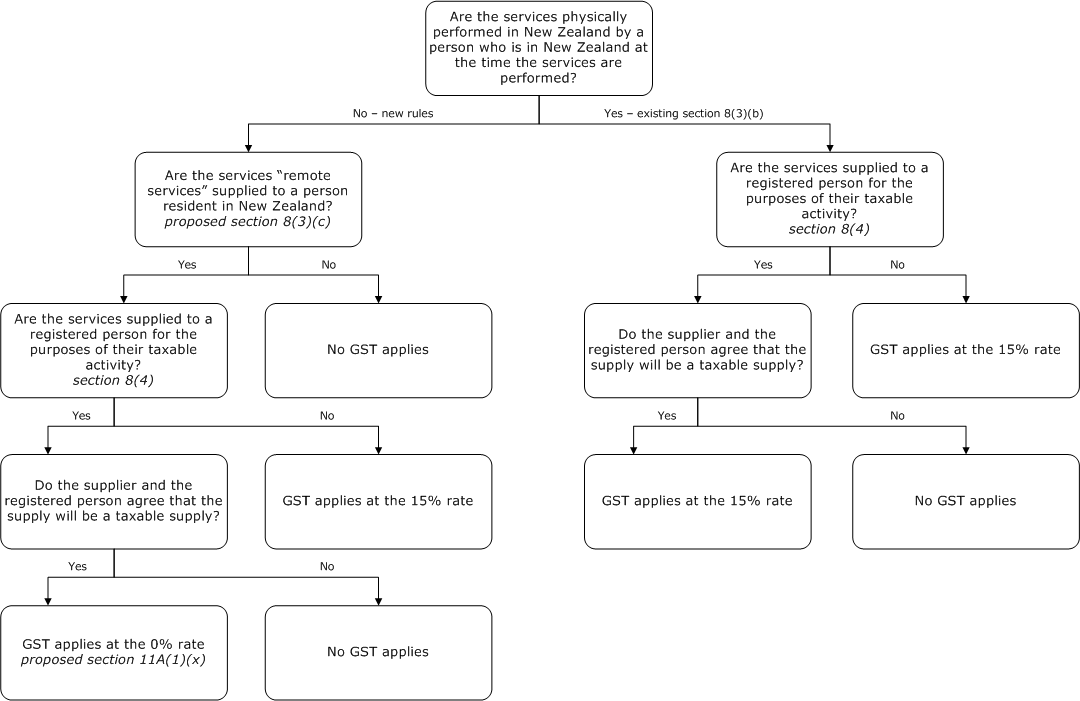

The amendments propose changes to the place of supply rules, so that GST applies to supplies of remote services that are physically performed outside New Zealand, where the services are supplied to a New Zealand resident.

Proposed section 8(3)(c) provides that services will be treated as being supplied in New Zealand (subject to GST) when a non-resident supplier supplies remote services to a New Zealand resident, unless the services are physically performed in New Zealand by a person who is in New Zealand at the time the services are performed (in which case the supply would be subject to GST under existing section 8(3)(b)).

Section 8(4) will apply to supplies made under proposed section 8(3)(c), so that remote services that are supplied to GST-registered businesses will be treated as being supplied outside New Zealand (not subject to GST), unless the supplier and the GST-registered recipient agree that the supply is a taxable supply. Where the parties have agreed, these supplies will be zero-rated under proposed section 11A(1)(x). (See following section of the commentary for more information on business-to-business supplies.)

Section 11A(1)(j) currently zero-rates services that are physically performed outside New Zealand or supplies that arrange services that are physically performed outside New Zealand. An amendment excludes supplies of remote services to a person resident in New Zealand that is not a registered person from this zero-rating rule. This creates a level playing field between resident and non-resident suppliers, as in both cases, GST will apply at the 15% rate when remote services are physically performed outside New Zealand and supplied to a New Zealand-resident consumer.

Example

Movie Co. is a non-resident company that provides remote services to consumers in a number of countries, including New Zealand. As some of these services are remote services supplied to a New Zealand-resident consumer, these supplies will be subject to GST under proposed section 8(3)(c). If Movie Co. exceeds the registration threshold, it will be required to register and return GST on these supplies.

If Movie Co. was a resident of New Zealand that physically performed remote services outside New Zealand, its supplies would also be subject to GST at the 15% rate when supplied to New Zealand-resident consumers, due to the proposed exception to section 11A(1)(j).

The new place of supply rule in section 8(3)(c) applies to services that are not physically performed in New Zealand by a person who is in New Zealand at the time of performance. The place where a service is “physically performed” can be considered to be the place where the service is actually carried out or performed. For these purposes, all services are “physically performed”, even if they are delivered through an automated process.

Services that are already exempt (such as supplies of financial services) or zero-rated under a specific rule would retain that character under the proposed amendments.

Summary of the new place of supply rules for non-resident suppliers of services

Definition of “remote service”

Under the GST Act, “services” are defined to include anything other than goods or money. “Goods” are defined to exclude “a product that is transmitted by a non-resident to a resident by means of a wire, cable, radio, optical or other electromagnetic system or by means of a similar technical system”. Treating intangible digital products as services is consistent with the OECD framework, and recognises that it is impractical to treat these products like imported goods, as they cannot be taxed at the border. The bill proposes an amendment to the definition of “goods” to remove the reference to a non-resident supplier and resident recipient, in order to ensure that intangible digital products will be treated as services regardless of the tax residence of the supplier and recipient.

A “remote service” is defined as a service that, at the time of the performance of the service, has no necessary connection between the physical location of the recipient and the place where the services are performed.

Whether a service is a “remote service” will depend on whether the nature of the service requires that the recipient is present when the service is physically performed. If a service is either actually or is capable of being supplied when the recipient is not present, the test will be satisfied, as there is no necessary connection between the physical location of the recipient and the place of physical performance.

Requiring a necessary connection between the physical location of the customer and the place of physical performance of services means that the definition of “remote services” includes services that are capable of being supplied remotely, but that happen to be provided when the recipient and provider are in the same location.

Examples of services that could be supplied as remote services include:

- supplies of digital content such as e-books, movies, TV shows, music and online newspaper subscriptions;

- online supplies of games, apps, software and software maintenance;

- webinars or distance learning courses;

- insurance services;

- gambling services;

- website design or publishing services; and

- legal, accounting or consultancy services.

Examples of services that would not be remote services include:

- accommodation services;

- hairdressing, beauty therapy and physiotherapy;

- car rental services;

- entry to cinema, theatre performances, sports events and museums;

- gym memberships;

- passenger transport services; and

- restaurant and catering services.

Example

Legal Co. is a non-resident company based in Australia. Sam, a New Zealand tax resident, seeks general advice from Legal Co. about investing in an Australian company. The nature of the service is such that Sam is not required to be present when the advice is provided, and in fact the advice is provided via telephone and email, rather than in person.

The services are remote services, as there is no necessary connection between Sam’s physical location and the place where the service is physically performed. If Legal Co exceeds the registration threshold, it will be required to register and return GST on this supply.

Telecommunications services

The GST Act includes special rules for cross-border supplies of telecommunications services, including specific place of supply and zero-rating rules. These rules determine the GST treatment of the supply based on the place that the customer is located when initiating or receiving services.

These rules zero-rate domestic telecommunications providers’ supplies of international roaming services to New Zealand residents who are temporarily offshore. Offshore telecommunications providers are, however, required to charge GST on services used by non-resident consumers that are temporarily in New Zealand (known as inbound roaming services), if the total value of their supplies exceeds the registration threshold. However, if the threshold is exceeded only because of supplies to non-residents that are physically present in New Zealand, they are not required to register. Offshore telecommunications providers must register for GST for services provided to New Zealand residents if they exceed the $60,000 threshold.

The amendments proposed in the bill are not intended to disturb the current tax settings for telecommunications services. Section 8(5) of the GST Act excludes these services from the application of the relevant provisions.

“Telecommunications services” are defined in the GST Act to include the transmission, emission or reception of information by certain technical systems, including access to global information networks, but to exclude the content of the telecommunication. This means that telecommunications services, such as telephone calls or access to the internet via an internet service provider, will not be subject to the new place of supply or electronic marketplace rules.

GST registration threshold

Non-resident suppliers of remote services to New Zealand customers will be required to register for GST if their total value of supplies made in New Zealand exceed NZ$60,000 in a 12-month period, which is equivalent to the existing registration threshold for resident suppliers.

As these suppliers will be subject to the rules contained in section 51 of the GST Act, non-resident suppliers will be required to register if:

- the total value of their supplies made in New Zealand in the past 12 months exceeded NZ$60,000 (unless the Commissioner of Inland Revenue is satisfied that their supplies in the next 12 months will not exceed this threshold); or

- the total value of their supplies made in New Zealand in the next 12 months is expected to exceed NZ$60,000.

As remote services supplied by a non-resident to a New Zealand GST-registered business are generally treated as not being supplied in New Zealand (and therefore not subject to GST), these supplies will not count towards the registration threshold. However, if the parties agree that the supplies will be zero-rated, these supplies will count towards the threshold.

Where a non-resident supplier of remote services is carrying on a taxable activity in New Zealand, and their supplies fall below the NZ$60,000 threshold, they will be able to voluntarily register for GST.

The existing rules that allow non-resident businesses to register for GST, which are contained in section 54B of the GST Act, will continue to apply. These rules allow a non-resident business that has been charged GST on goods or services received in New Zealand, but that does not carry on a taxable activity in New Zealand, to register and claim back the GST paid, provided certain conditions are met.

Example

Music Co., a non-resident company based in the United States, supplies access to music on a subscription basis over the internet. Music Co also supplies licences for businesses such as restaurants and bars to play music in a commercial setting.

Each year, Music Co. makes supplies valued at NZ$50,000 to New Zealand customers who are not GST-registered. It makes supplies valued at NZ$20,000 to New Zealand GST-registered customers.

Unless Music Co. chooses to agree with its GST-registered business customers that these supplies that would bring them over the registration threshold are zero-rated, Music Co. will not be required to register and return GST on any of its supplies in New Zealand, as it has not exceeded the NZ$60,000 registration threshold.

Determining whether a customer is resident in New Zealand

When applying the new place of supply rules, a supplier will not be required to determine precisely whether their customer is a tax resident of New Zealand, and will instead be able to use objective proxies to determine the GST treatment of the supply. Under the proposed rules, an offshore supplier of remote services would be required to determine whether a customer is a New Zealand resident on the basis of two non-conflicting pieces of evidence.

This test is intended to strike a balance between accuracy in determining whether New Zealand GST should apply and the compliance costs imposed on offshore suppliers. The proposed rules will provide non-resident suppliers with certainty when determining whether a recipient of a supply should be treated as a New Zealand-resident. The test should also be familiar to many non-resident suppliers as the proposed approach is consistent with similar rules that apply in the European Union.

Proposed section 8B(2) provides a list of proxies that can be used for these purposes:

- the person’s billing address;

- the internet protocol (IP) address of the device used by the person or another geolocation method;

- the person’s bank details, including the account the person uses for payment or the billing address held by the bank;

- the mobile country code (MCC) of the international mobile subscriber identity (IMSI) stored on the subscriber identity module (SIM) card used by the person;

- the location of the person’s fixed landline through which the service is supplied to them; or

- other commercially relevant information.

The supplier can use one or more pieces of other commercially relevant information to determine whether a person is resident in New Zealand, rather than using the other proxies that are listed. Examples of other commercially relevant information are the customer’s trading history (such as the previous billing address of the customer) or the product purchased if it is linked to a geographic location (for example, some gift cards may only be used in a particular country). Information provided by a third party, such as by a payment service provider, can also be used if it is commercially relevant.

The rules are therefore intended to provide flexibility for suppliers, as the information that will be available to different businesses will vary and may change due to changes in technology and new business models. Compliance costs are reduced when a business is able to use information that it routinely collects through its normal processes, rather than having to request additional information from its customers for tax purposes.

Under proposed section 8B(3)(a), if a supplier has more than one set of evidence that meets the test, where one set supports the conclusion that the customer is resident in New Zealand and another supports the conclusion that the customer is resident in another country, the supplier is required to choose the more reliable set of evidence. Which items are more reliable will depend on the circumstances. For example, where the supplier applies the same price regardless of the country of the customer, the recipient’s billing address could be a more reliable indicator than would otherwise be the case.

Example

Jacob, a New Zealand tax resident, purchases a navigational app on his phone while on holiday in the United States. The app store collects two pieces of evidence that supports the conclusion that Jacob is resident in New Zealand, which are his credit card information and the records of his billing addresses from transaction history with the app store.

The app store also has two pieces of evidence that suggest Jacob is resident in the United States, which are the SIM card in the phone he is using and his IP address. Proposed section 8B(3)(a) requires the app store to use the set of evidence that is more reliable to determine whether GST applies in New Zealand.

The app store has implemented system rules that give priority to its customers’ credit card information and transaction history, as these indicators are more reliable in the context of their business. On this basis, the app store treats Jacob as a New Zealand resident, and charges New Zealand GST on the supply.

To provide additional flexibility, proposed section 8B(3)(b) enables the Commissioner of Inland Revenue to prescribe an alternative method of determining whether a customer is resident in New Zealand, in circumstances where sufficient information is not commercially available to apply the test. This information could be published by the Commissioner.

Non-double taxation rule

Under the current place of supply rules, GST would apply to services that are physically performed in New Zealand and supplied to a non-resident who is in New Zealand. However, according to the OECD guidelines, if that service was a remote service, the country of the consumer’s usual residence would have taxing rights over this consumption.

Proposed section 20(3)(dc) prevents double taxation from arising on supplies of remote services that are physically performed in New Zealand to a non-resident consumer in New Zealand, by allowing a deduction that offsets their liability for GST in New Zealand to the extent that the supply has already been taxed in another jurisdiction.

Proposed section 20(3)(dc) provides a deduction for the New Zealand GST charged when:

- there is a supply of remote services that are physically performed in New Zealand and supplied to a non-resident person in New Zealand who is not registered for New Zealand GST; and

- the supplier has, in relation to the supply, incurred liability for, returned and paid a consumption tax in another jurisdiction.

The deduction will be limited to the extent of the consumption tax paid in the other jurisdiction.

Example

After the proposed Australian rules for cross-border services are implemented, Book Co. a New Zealand seller of e-books, supplies e-books to an Australian resident who is temporarily in New Zealand on holiday. Book Co. is liable for and has returned and paid GST in Australia. Therefore, new section 20(3)(dc) will allow it to claim a deduction against the New Zealand GST charged on the supply. As the Australian GST rate is 10%, Book Co. effectively returns output tax of 5% on the supply.

Effect on suppliers’ residency and income tax obligations

Although these amendments treat certain services provided by non-residents as “supplied in New Zealand”, there is no intention that this will have a broader impact on whether a supplier is a resident of New Zealand for GST or income tax purposes, or whether a supplier has a “permanent establishment” in New Zealand.

The definition of “resident” in the GST Act includes a resident as defined in the Income Tax Act 2007. For GST purposes, a person is also considered to be a resident of New Zealand to the extent that the person carries on a taxable activity or other activity in New Zealand, and has a fixed or permanent place in New Zealand relating to that activity. The proposed amendments will not affect the extent to which a person carries on an activity in New Zealand, despite their effect of making certain supplies taxable for GST purposes.

Double tax agreements primarily deal with whether a resident of one country is subject to income tax on income derived in another country. The concept of “permanent establishment” is used in double tax agreements between New Zealand and other countries. Under double tax agreements, a company that does not have a “permanent establishment” in New Zealand will have no New Zealand income tax. The fact that a supplier is registered for New Zealand GST under the proposed rules should not affect whether or not the supplier has a “permanent establishment” in New Zealand for double tax agreement purposes or the application of the definition of resident used for GST purposes.