Other policy matters

GST AND BODIES CORPORATE

(Clauses 249, 250, 251, 253 and 254)

Summary of proposed amendments

The amendments clarify that services provided by bodies corporate are supplies for consideration for goods and services tax (GST) purposes and give bodies corporate the option to register for GST. Rules to protect the tax base from any adverse consequences of allowing this choice are included in the proposed amendments.

Application dates

The proposed amendments apply from the date of the bill’s introduction, with the exception of the definition of body corporate, as well as proposed sections 5(8A) and 51(1B), which have an application date of 1 October 1986 (the date the Goods and Services Tax Act 1985 came into effect).

Key features

Under the proposed rules, section 2 defines a “body corporate” as having the same meaning as under the Unit Titles Act 2010 but excludes a body corporate of a retirement village registered under the Retirement Villages Act 2003. “Common property” is also defined in section 2 and has the same meaning as in the Unit Titles Act 2010.

Proposed section 5(8A) clarifies that levies and other amounts paid by a body corporate’s members to the body corporate are treated as being consideration received for services supplied by the body corporate to its members. Despite this, proposed section 51(1B) excludes the value of the body corporate supplies to members, from the body corporate’s total value of supplies, when determining whether the body corporate is required to register under section 51(1). This means that if a body corporate only makes supplies to its members, it will not be required to register, even if the value of the levies or other amounts exceeds the $60,000 registration threshold.

However, if a body corporate is required to register because supplies to third parties exceed the registration threshold, or the body corporate decides to voluntarily register, it will be required to return output tax on the full value of both its body corporate and third-party supplies.

Proposed section 51(5B) provides that a body corporate that makes an application to voluntarily register after the introduction of the bill, must be registered with effect from a date after the registration application date.

If a body corporate decides to register, or is required to do so, proposed section 5(8AB) treats any funds held by the corporate at the date of registration as a supply of services for consideration in the course or furtherance of its taxable activity. The supply of services is treated as performed on the day of registration.

Bodies corporate that were registered before the date of introduction, but decided to cancel their registration post-introduction, are only able to deregister from the date they applied to cancel their registration (proposed section 52(8)). A proposed addition to section 10(7A) ensures that any common property held by the body corporate at the time of deregistration is valued at zero. This will mean the body corporate is not required to return output tax on those assets held at the time its registration ceases.

Proposed section 52(9) provides that a body corporate that registers for GST after the date of introduction cannot deregister for a period of four years.

Background

A body corporate is a legal entity created under the Unit Titles Act 2010 when multiple owners have unit title properties in an apartment building or similar complex. The body corporate comprises all of the property owners and provides a way for the owners to act together in relation to their common and shared interests. Bodies corporate are responsible for managing, maintaining, repairing and organising insurance for the building and common property areas, and for making and enforcing the body corporate operational rules.

Bodies corporate are a product of unit owners undertaking joint actions for their mutual benefit. Funds of the body corporate are held in expectation that they will all be spent. This means that from a GST perspective, bodies corporate should be largely GST-neutral.

Currently, most of New Zealand’s approximately 13,800 bodies corporate are not registered for GST, and Inland Revenue’s historic position was not to allow bodies corporate to register. A High Court decision in Taupo Ika Nui Body Corporate v CIR (1997) 18 NZTC 13,147, appeared to support this position by suggesting that many bodies corporate would not be required to register for GST because they did not make supplies to unit owners for consideration.

More recently, Inland Revenue was asked to revisit the question of whether bodies corporate should be able to register for GST. To answer this question, Inland Revenue undertook a legal analysis and came to a different view which was that a body corporate could be considered to make supplies to its owners and therefore carry on a taxable activity. A consequence of this view is that, if a body corporate makes supplies that exceed the $60,000 threshold, it would be required to register for GST.

Given the historic position, the new interpretation could adversely affect thousands of property owners, as it would require a large number of bodies corporate to register for GST.

The proposed amendments clarify that services provided by bodies corporate are supplies for consideration for GST purposes and give bodies corporate the option to be registered. This ensures that bodies corporate that are not currently registered will not have to do so unless they would be required to do so because of the level of their supplies to non-members or third parties. It also gives certainty to bodies corporate already registered for GST as these bodies corporate will be able to remain registered.

The approach proposed in this bill replaces that set out in the Government discussion document, GST treatment of bodies corporate, released on 6 June 2014.

Detailed analysis

Proposed section 5(8A) clarifies that body corporate levies are consideration for a supply by the body corporate to its members. This rule has an application date of 1 October 1986 (the date that GST took effect). This is to ensure that bodies corporate that registered before the date of the bill’s introduction have that position confirmed by legislation.

Proposed section 51(1B) excludes the value of supplies to members, from the body corporate’s total value of supplies, when determining whether the body corporate is required to register under section 51(1). This should give the majority of bodies corporate the option of registering for GST, unless their supplies to third parties exceed $60,000, in which case they will be required to be registered.

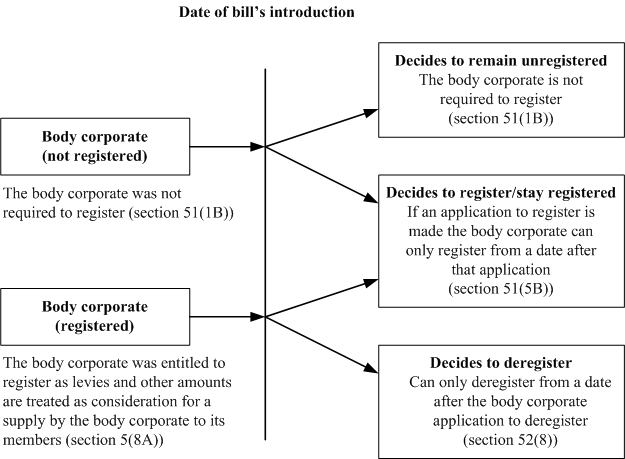

The effect of the proposed rules is summarised in the following diagram:

Retirement villages registered under the Retirement Villages Act 2003 are excluded from the new rules (see new definition of “body corporate”). This is because the nature of supplies that retirement villages provide can be distinguished from supplies made by a typical body corporate. This is recognised by the Unit Titles Act 2010, as significant parts of the Act do not apply to retirement villages.

The bill also proposes rules to protect the tax base from any adverse consequences that could arise as a result of allowing bodies corporate the option to register. This is achieved by imposing an output tax liability on any funds held by the body corporate at the time of registration if a body corporate decides to register after the bill’s introduction date (new section 5(8AB)). This prevents a body corporate from obtaining a tax advantage by accumulating untaxed funds while it is not registered and then registering to claim input tax deductions when it spends the funds. The amendment, which will apply on the date of the bill’s introduction, ensures bodies corporate remain GST-neutral.

A body corporate’s “funds” include all cash and non-cash investments held by the body corporate. The new rule is intended to ensure a body corporate cannot restructure its cash reserves to avoid the application of output tax upon registration. “Funds” will include a body corporate’s operating account, long-term maintenance fund, contingency fund and any capital improvement fund (see definition of “fund” under the Unit Titles Act 2010). Any financial investments held by the body corporate are also included (see section 130 of the Unit Titles Act 2010).

Proposed section 51(5B) requires that a body corporate that makes an application to voluntarily register after the introduction of the bill must be registered with effect from a date after the registration application date. This prevents bodies corporate from backdating their registration. Registration backdated prior to the introduction of the bill would have the effect of avoiding the output tax liability imposed under proposed section 5(8AB), discussed above. Conversely, bodies corporate that were registered prior to the date of introduction, but decide to deregister post-introduction, are only able to deregister from the date they applied to cancel their registration (see section 52(8)). This prevents bodies corporate from backdating their registration cancellation to a time that is most advantageous to them.

A body corporate seeking to deregister will not be refunded any GST paid on its funds held at the time of deregistration. This is consistent with the treatment of other registered taxpayers leaving the GST system. There is also likely to be a point on the “save and spend” cycle of a body corporate’s activities when its accumulated funds are very low and it can exit the GST base with limited financial impact.

A four-year lock-in rule is proposed to prevent bodies corporate from continually changing their registration status (new section 52(9)). It applies when a body corporate registers after the date of introduction and then later applies to cancel its registration. The cancellation can only take effect on, or after the later of:

- the date on which the body corporate applies to cancel its registration, or

- the day that is four years after the day of registration.

Under the proposed rules, body corporate supplies to third parties still count towards the $60,000 registration threshold. These supplies are treated like any other supply for GST purposes and consequently, if a body corporate’s supplies to third parties exceed the $60,000 registration threshold, it will be required to register. This will mean the body corporate will be required to return output tax on any funds on hand at the time of registration. This is considered preferable to treating supplies to third parties as separate from body corporate supplies, with only third-party supplies making up the body corporate’s taxable activity. A segregated approach would require the body corporate to apportion its input tax deductions depending upon which supplies they relate to. This could impose significant compliance costs on bodies corporate.

As the exclusion in proposed section 51(1B) only applies for the purposes of section 51(1), once registered a body corporate must return output tax on the value of all the supplies it makes (both body corporate supplies and third-party supplies) in the usual way.

ANNUAL SETTING OF INCOME TAX RATES

(Clause 65)

Summary of proposed amendment

The bill sets the annual income tax rates that will apply for the 2015–16 tax year. The annual rates to be set are the same that applied for the 2014–15 tax year.

Application date

The provision will apply for the 2015–16 tax year.

Key features

The annual income tax rates for the 2015–16 tax year will be set at the rates specified in schedule 1 of the Income Tax Act 2007.

CHILD SUPPORT

(Clauses 3 to 64)

Summary of proposed amendments

The amendments seek to simplify the administration of the Child Support Scheme established by the Child Support Act 1991. There are also changes which seek to ensure that the policy objectives in the Child Support Amendment Act 2013 are achieved by correcting minor errors, clarifying wording and making additional consequential amendments to simplify the Child Support Scheme.

Application date

With some exceptions, the amendments come into force on the day after the date the bill receives Royal assent. However, the following clauses come into force on 1 April 2015:

- clauses 4, 49(1) and (2), and 50(2) to (7) (Interpretation, Application, Transitional and Savings Provisions);

- clause 15 (Living Allowance);

- clauses 23 and 28(2) (Penalties for underestimation of taxable income).

Clauses 31(2), 40(3) and (4), and 41(2) come into force on 1 April 2016.

Clauses 52, 56 and 57 come into force on the date on which the bill receives Royal assent.

Key features

The bill proposes that some of the child support reforms per the Child Support Amendment Act 2013 be repealed or amended. The changes to the reforms focus principally on the options for making payments or the method of recognising special circumstances for assessment purposes, and also focus on reducing debt.

The bill also proposes remedial changes to the Child Support Act 1991 and the Child Support Amendment Act 2013. The following remedial changes are intended to provide a simpler and improved Child Support Scheme, with positive or no impact on families:

- The definition of “social security benefit” (and “beneficiary”) will be changed to exclude sole parents who are full-time students and who claim a Jobseeker Support payment on the grounds of student hardship between academic years. For child support purposes, they will be treated in the same manner as full-time students receiving a student allowance (clause 4(3) and (4)).

- Removing the ability in some situations for only one parent to end an assessment, particularly when it is based on estimated income. Removing the ability to unilaterally “opt out” will provide greater certainty about assessments and a reduced number of situations when retrospective assessments and debts occur (clauses 10, 11, 24(3), 28(1) and (47)).

- Changing the requirements regarding notices of assessment and entitlement to cope with unusual situations when the required amount differs from the usual assessment – for example, departures to a formula assessment (clauses 25 and 26);

- Allowing the Commissioner of Inland Revenue to make determinations that differ from what is applied for under the original departure application if the result of the determination is correct and fair, without the need for a cross-application or re-application to be made (clause 31(3));

- Allowing a parent to object to an amended assessment even when their final liability or entitlement has not changed, but a component within it has changed (clause 29(1) and (2));

- Currently, if a receiving carer receives an Unsupported Child Benefit for one child they are unable to end a child support assessment for any other children they care for, even when they are not receiving a benefit in respect of those other children. The ability to end an assessment would be widened to apply with respect to the children for whom the carer is not receiving a benefit, allowing them to set up voluntary arrangements (clause 11).

The proposed remedial changes to clarify the legislation, correct errors or make the Scheme easier to understand include:

- updating references to “welfare benefits” to reflect the new names and eligibility criteria following the welfare reform and ensure the child support living allowance is connected to the correct new benefit (clause 15);

- clarifying who can appeal a decision by the Commissioner to disallow an objection to an assessment (that is, the original objector can appeal rather than any person) (clause 29(3));

- having consistent use of the defined term “annual rate of child support” in the Act (clauses 12 and 36);

- clarifying how the split of the minimum amount of child support works when the liable parent has a formula assessment and voluntary agreement in place (clause 12);

- ensuring the estimation of taxable income sections still work when an overseas parent lives in a country where tax is not payable on income (clause 16);

- clarifying who the parties are in an application to be declared a step-parent (clause 37);

- making clear the time periods and income limits being referred to in the new administrative review ground on income earned to cover re-establishment costs (clauses 40 and 41);

- clarifying who can elect to end a Commissioner-initiated administrative review (clauses 32 to 35);

- clarifying the parties in various appeals such as an appeal to a decision establishing the proportions of shared care (clauses 38 and 39);

- restoring an earlier provision that allows information to be communicated to other agencies by the Commissioner in relation to threats made by the liable parent against the receiving carer. This used to apply to a spousal maintenance relationship but was inadvertently narrowed to just child support assessment relationships (clause 48).

Background

The Child Support Act 1991 sets out the requirements for individuals to apply for, be assessed on, and make and receive child support payments. It contains procedures for changes to assessments, determinations of liabilities, objections and appeal procedures via the Family Court regarding child support assessments. There are also provisions dealing with debt collection, penalties and debt write-offs of child support.

The Child Support Amendment Act 2013 implemented major reform of the Child Support Act to bring in a new, more detailed formula assessment which takes into consideration the costs of raising children and also the incomes of both parents. It also:

- changes the way a liable parent and a receiving carer is determined;

- recognises a greater number of people involved in the care of a child;

- provides greater options for the payment of child support;

- encourages payment of child support obligations; and

- provides greater flexibility for the Commissioner of Inland Revenue to manage child support debt.

The intention of the changes is to improve fairness of the Child Support Scheme by taking into account a wider range of individual circumstances and to reflect changes in family structure and involvement in bringing up children since the Child Support Scheme was first introduced.

The amendments in Part 1 of the Child Support Amendment Act were to come into force on 1 April 2014 and Part 2 of that Act was to come into force on 1 April 2015. Those dates were delayed by one year under provisions contained in the Taxation (Annual Rates, Foreign Superannuation, and Remedial Matters) Amendment Act 2014. This was to allow Inland Revenue additional time to implement the changes to the quality standard required.

Remedial changes were also made under the Taxation (Annual Rates, Employee Allowances, and Remedial Matters) Act 2014.

The bill proposes that some of the child support reforms per the Child Support Amendment Act, the Child Support Act and the Taxation Amendment Acts be repealed or amended. The changes to the reforms do not affect the new framework of how child support is determined and who is responsible for paying child support – they concern the administration of the scheme – principally the options for making payments or the method of recognising special circumstances for assessment purposes.

Under proposals in the bill, the following aspects of the reforms will no longer proceed and be repealed in the Child Support Amendment Act:

- compulsory deductions of child support from employment income, and the associated grounds for an exception such as privacy or cultural reasons (a new provision for voluntary deductions will achieve similar outcomes) (clause 54);

- the new definition of “adjusted taxable income”, which includes income adjustments to taxable income, such as income in trusts and companies (an existing administrative ground can be used instead) (clauses 13, 14 and 17 to 22);

- a penalty for receiving carers who are parents and who underestimate their income for the year (existing provisions can achieve some similar outcomes) (clause 23);

- the ability to offset current payments against past debts where the liable parent and receiving carer swap roles (a new administrative review ground will be used instead) (clause 58);

- the discretion to recognise other payments, such as payment of school fees qualifying as child support payments when they directly benefit the child (as existing provisions can achieve similar outcomes) (clause 54).

CHARITIES WITH OVERSEAS PURPOSES

(Clause 218)

Summary of proposed amendment

The bill proposes adding 10 new charitable organisations to schedule 32 of the Income Tax Act 2007. Donors to the following charities will then be eligible for tax benefits on their donations:

- Adullam Humanitarian Aid Trust

- Bicycles for Humanity, Auckland

- Face Nepal Charitable Trust Board New Zealand

- Hagar Humanitarian Aid Trust

- Himalayan Trust

- International Needs Humanitarian Aid Trust

- Mercy Ships New Zealand

- Orphans Aid International Charitable Trust

- ShelterBox New Zealand Charitable Trust

- So They Can

In addition, Aotearoa Development Cooperative is to be renamed as ADC Incorporated following an organisation restructure by the charity.

Application date

The amendments will apply on 1 April 2015.

The renaming of Aotearoa Development Cooperative to ADC Incorporated will have effect from 20 June 2014. Reference to Aotearoa Development Cooperative will be removed from schedule 32 on and after 1 April 2015.

Background

Donors to organisations listed in schedule 32 are entitled as individual taxpayers, to a tax credit of 33⅓% of the monetary amount donated, up to the value of their taxable income. Companies and Māori authorities may claim a deduction for donations up to the level of their net income. Charities that apply funds towards purposes that are mostly outside New Zealand must fulfil a number of requirements and be listed in schedule 32 of the Income Tax Act 2007 before donors become eligible for these tax benefits.

The 10 charitable organisations proposed to be added to schedule 32 in this bill are engaged in the following activities:

- Adullam Humanitarian Aid Trust: Formerly known as Barnabas Aid for Syria, the Trust was established in 2012 to provide aid and relieve the suffering, poverty and distress for communities caught up in natural disasters, civil strife, human rights abuses, war, oppression and violence. The Trust is currently active in Syria and is using a network of Christian churches to deliver aid to dislocated communities affected by the Syrian civil war. Aid is not restricted to church members. All individuals in need are equally eligible to receive aid when they are part of the same community that is suffering the distress which the Trust is seeking to relieve.

- Bicycles for Humanity, Auckland: This Trust is the Auckland chapter of the global Bicycles for Humanity network which provides second-hand bicycles, spare parts, and tools and accessories to impoverished communities in developing countries. Established in 2013, the Trust is working towards making its first shipment of second-hand bicycles to Namibia with the assistance of the Bicycle Empowerment Network. Following this, the trustees will consider a similar shipment to a South Pacific nation.

- Face Nepal Charitable Trust Board New Zealand: Since 2010, Face Nepal’s objective is to provide economic and educational resources directed at the alleviation of poverty in Nepal. Its activities largely focus on arranging and co-ordinating volunteer work to support projects identified by the Nepali community.

- Hagar Humanitarian Aid Trust: The Hagar Humanitarian Aid Trust, formerly operating as Hagar New Zealand Charitable Trust was set up in 2009 to assist with the recovery and empowerment of women and children who are victims of human rights abuses, particularly human trafficking, sexual exploitation and gender-based violence. The Trust is active in supporting missions in Afghanistan, Cambodia, Viet Nam and Myanmar.

- Himalayan Trust: Established in 2008, the objective of the Trust is to provide medical and public health facilities and supplies, assistance in or towards quality education and improved facilities for Himalayan people. The Trust’s work focuses on education, health and environmental protection. In various guises, the Trust has been operating since 1966 and was previously known as The Himalayan Trust Board (1974) and before that The Sherpa Trust Board (1966).

- International Needs Humanitarian Aid Trust: The Trust works in support of poor communities in over 33 countries in the developing world, including Pacific Island nations. It specifically funds projects directed at community development, vocational education, micro-credit, child-focused programmes and disaster relief. The Trust was formed in 2008 as an associated Trust to International Needs New Zealand (INNZ), which has been operating since 1972, specifically to be the operating arm of INNZ to carry out humanitarian work as described.

- Mercy Ships New Zealand: Through the use of hospital ships, Mercy Ships is involved in the provision of medical services and surgery in West Africa. It also provides medical training to build technical medical capacity in the host country. Mercy Ships New Zealand was set up in 2003 to support the work of Mercy Ships International which was founded in 1978.

- Orphans Aid International Charitable Trust: Established in 2004, the Trust was set up to provide social, medical and housing assistance to Romania’s orphans. It also now actively supports projects in India directed at relieving child poverty, including education, and providing opportunities for women to develop work skills and run microbusinesses. They have recently become active in Uganda in projects aimed at preventing child abandonment and poverty.

- ShelterBox New Zealand Charitable Trust: The Trust was set up in New Zealand in 2013 and is part of a global network of 18 affiliates directed at providing those stricken by disaster with a relief package for basic shelter and on-going self-sufficiency. Most recently, the New Zealand Trust was involved in funding shelter boxes and delivery of relief in the Philippines following the devastating typhoon of October 2013.

- So They Can: The organisation is predominantly active in Kenya, and supports a number of projects directed at relieving child poverty and providing opportunities for women to develop work skills and run their own businesses. Funds are raised through a child sponsorship programme, grants from corporate and private foundations, and fundraising events. The Trust formerly operated under the name Breathe Foundation (2010)

Aotearoa Development Cooperative was added to the list of donee organisations in schedule 32 on 1 April 2013. It works with poor communities in Burma. In 2014 the charity restructured and became an incorporated society from 20 June 2014. The proposed change preserves the charity’s donee status for the 2014 and later income years.

CALCULATION OF FRINGE BENEFITS FROM EMPLOYMENT-RELATED LOANS

(Clause 203)

Summary of proposed amendment

The amendment will allow employers who are part of the same group of companies as a person in the business of lending money to the public, the option of using the market interest rate method to calculate the fringe benefit arising from an employment-related loan.

Application date

The amendment will come into force on the date of enactment.

Key features

Currently only persons who are in the business of lending money to the public can use the market interest rate method to determine the fringe benefit arising from an employment-related loan. That method requires the employer to assess what the market interest rate would be on a comparable loan to an unrelated third-party borrower.

The proposed amendment will allow an employer who is a member of the same group of companies as a person who is in the business of lending money to the public, to use this method of valuing an employment-related loan.

The proposed amendment includes transitional rules to waive the normal change of method notification period so that an affected employer can apply the market interest rate method soon after enactment. If the election notice is provided before 1 April 2016, the market interest rate method can be applied from the quarter following notification. For a part-year period, the employer may treat this period as a whole income year for the purposes of satisfying the requirement that the method is applied for at least two income years. To qualify the employer must be paying fringe benefit tax (FBT) on a quarterly basis.

Background

When a person receives a loan from their employer at less than market interest, a fringe benefit arises, as the employee benefits from the reduced interest expense.This fringe benefit is subject to FBT.

To limit compliance costs, most employers must calculate the fringe benefit arising from the loan by comparing the interest accruing under the loan with the interest that would accrue if the loan was at the prescribed interest rate, which is set by regulation.The prescribed rate is set with reference to the Reserve Bank’s survey of published floating first mortgage interest rates.

Since 2006, an employer in the business of lending money to the public has had the additional option of valuing the fringe benefit by comparing the rate of interest under the loan with the rate of interest that they charge on a comparable loan made to an unrelated borrower.

This additional option was provided because persons who lend money to the public were expected to have systems in place to easily monitor movements in market rates of interest, and could therefore apply the market interest rate method without difficulty.

The option for valuing the fringe benefit was not extended to other employers, as the compliance costs associated with the option would not make it worthwhile.

An issue has since emerged where employers whose employees receive discounted loans under an arrangement with a lender within the same group of companies cannot apply the market interest rate method to value the benefit when the employer itself is not lending to the public. These employers are required to value the benefit using the prescribed interest rate, which may lead to their having a slightly higher FBT liability because it does not factor in market discounts that may be available.

As it is anticipated that the employer will be able to obtain information on market interest rates from the lender, these employers too should be able to apply the market interest rate method without difficulty. Accordingly, the proposed amendment to give these employers the option of applying the market interest rate method should not have any compliance cost implications.