Background

The new rules represent a fundamental change to how New Zealand taxes offshore income earned through controlled foreign companies. The old system of taxing that income as it is earned is replaced by one that exempts the active offshore income of these companies. Further important features of the changes are an exemption from tax for most foreign dividends paid to companies and measures to protect the tax base as a result of adopting an active income exemption.

The purpose of these reforms is to bring New Zealand’s tax rules into line with the practice in other countries and help New Zealand-based business to compete more effectively in foreign markets by freeing them from a tax cost that similar companies in other countries do not face. The changes will improve the competitiveness of New Zealand’s tax system and encourage businesses with international operations to remain, establish and expand.

Previously, New Zealand residents were taxed on their share of all income earned by controlled foreign companies (CFCs) as that income accrued but with two significant exemptions:

- The “grey list” provided an exemption from accrual taxation for CFCs based in one of eight listed countries (Australia, Canada, Germany, Japan, Norway, Spain, the United Kingdom and the United States).

- Conduit tax relief provided an exemption from accrual taxation for a New Zealand company with an income interest in a CFC to the extent that the New Zealand company was owned by non-residents.

New Zealand companies receiving foreign dividends were generally required to make a foreign dividend payment (FDP). Credits were available for foreign withholding taxes on the dividend, and also, for non-portfolio dividends, for foreign taxes on the underlying profits. A company receiving a non-portfolio dividend from a grey list country qualified for a deemed underlying foreign tax credit equal to its FDP liability on the dividend. Credits were also available under the branch equivalent tax account (BETA) mechanism to prevent double New Zealand taxation under the CFC and FDP rules.

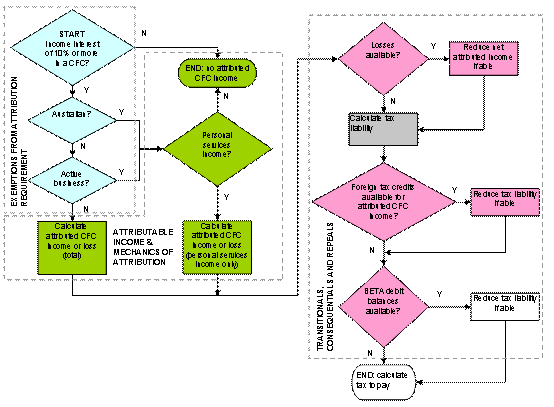

Under the new rules, only certain types of income derived by CFCs will be attributed back to New Zealand shareholders. A “signposting” provision in section EX 18A shows how to find a person’s attributed CFC income or loss under the amended legislation.

Figure 1 below summarises how the new CFC rules are applied and where in this report they are explained.

Figure 1: using the new CFC rules

Attributable income

Attributable income is referred to in the Act as the attributable CFC amount (a gross concept defined in section EX 20B) and as net attributable CFC income or loss (a net amount determined under sections EX 20C to EX 20E). In very broad terms, attributable income comprises passive income such as rent, royalties, certain dividends and interest. Taxing this income on accrual protects the domestic tax base against New Zealand-sourced income being shifted offshore to avoid tax.

In earlier policy documents, the terms “passive income” and “passive income definition” were used to describe the attributable CFC amount.

Exemptions from attribution requirement

Under the new rules, the grey list and conduit exemptions have been repealed. Two categories of CFC are now exempt from the requirement to attribute income:

- Non-attributing active CFCs (section EX 21B). If less than 5 percent of a CFC’s total income is attributable income, it is a non-attributing active CFC and neither its income nor its losses are attributable. This test may be undertaken either by applying the tax rules for measuring income (section EX 21D) or by reference to financial accounts, subject to certain adjustments (sections EX 21C and EX 21E).

- Non-attributing Australian CFCs (section EX 22). Broadly, if a CFC is resident and subject to tax in Australia, it is a non-attributing Australian CFC and is exempt from attribution.

Interest allocation rules

The interest allocation rules in subpart FE are designed to prevent an excessive amount of debt from being allocated against the domestic tax base. Previously, these rules only applied to New Zealand entities controlled by non-residents. Now that much of the income derived by CFCs remains outside the New Zealand tax base, the rules have been extended so that they also apply to outbound entities – New Zealand residents with CFC interests, regardless of whether the entity is controlled by a non-resident.

The rules place an upper limit on interest deductions that can be taken against domestic income. Subpart FE already contains safe harbours and these also apply to outbound entities: interest deductions are not restricted unless the New Zealand group debt percentage is more than 75 percent (and, for a company or a trustee, is also more than 110 percent of the worldwide group debt percentage). Additional safe harbours and reliefs have been introduced for outbound entities which have most of their assets in New Zealand or have only modest interest deductions.

Treatment of foreign dividends

The FDP rules in subpart RG have been repealed so that most foreign dividends received by New Zealand companies will now be wholly exempt.

Foreign dividends that are tax-deductible for the foreign company and dividends on fixed-rate shares are subject to income tax (section CW 9(2)(b) and (c)). If the foreign company is a CFC and the fixed rate or deductible dividend is paid to another CFC or New Zealand company, these distributions will be deductible in the same way as interest when calculating net attributable CFC income or loss. This prevents economic double taxation of attributable CFC income subsequently repatriated as a taxable dividend.

Dividends from non-attributing portfolio FIFs (that have less than 10 percent interest in a foreign company as described in sections EX 31, EX 32, EX 36, EX 37, EX 37B or EX 39) will also be subject to income tax.